Meta Description:

Discover the best emergency cash advance apps in the USA for 2025. Get fast cash with no hassle—compare top apps, features, and real stories.

Introduction:

Life doesn’t wait—and neither do emergencies.

When David, a single father in Ohio, suddenly faced a $900 car repair bill just days before payday, he didn’t know where to turn. Like millions of Americans, he didn’t have savings on hand. That’s when he discovered emergency cash advance apps—a lifeline that helped him get back on the road, fast.

In today’s economy, unexpected expenses can hit at the worst possible times. According to a 2025 Federal Reserve report, over 60% of U.S. households cannot cover a $1,000 emergency without borrowing. Whether it’s a medical bill, rent due, or car trouble, emergency cash advance apps have become a go-to solution for Americans needing instant cash without the red tape of traditional banks.

This guide dives into the best emergency cash advance apps USA 2025, exploring real-life stories, app features, pros, cons, and everything you need to make an informed, safe decision.

Why Emergency Cash Advance Apps Are Booming in 2025

Americans are facing rising living costs, unpredictable income streams (especially gig workers), and shrinking access to traditional loans. That’s why emergency loan apps are gaining popularity—they offer:

- Quick access to funds, often same-day

- No hard credit checks

- Flexible repayment tied to your paycheck

- Mobile convenience—borrow, track, and repay all from your phone

Real-Life Snapshot: Emily, Nurse in Florida

After a medical emergency with her son, Emily needed $600 fast. Instead of overdrafting her account or using a high-interest credit card, she used the app Earnin, which let her borrow money based on her hours already worked. “It was stress-free and saved me from massive fees,” she says.

Top 7 Best Emergency Cash Advance Apps USA (2025 Edition)

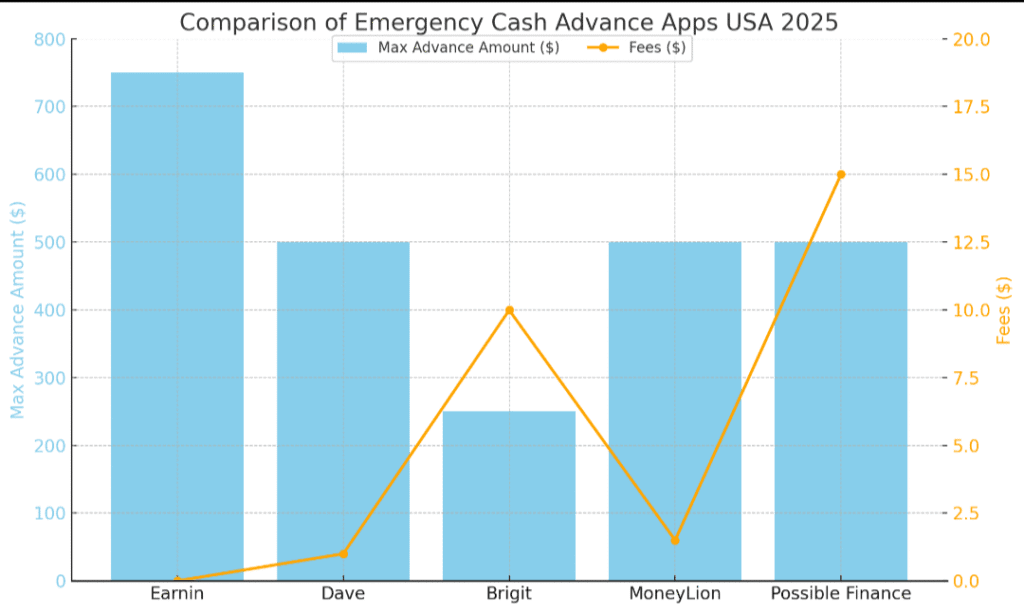

1. Earnin – Best for Low Fees

- Advance Amount: Up to $750 per pay period

- Fees: No mandatory fees; optional tips

- Turnaround Time: Same day or within 24 hours

- Requirements: Regular paycheck, direct deposit

Pros:

✔ No credit check

✔ Easy-to-use app interface

✔ Optional tip model

Cons:

✘ Can’t access if self-employed

✘ Must track work hours

Visual Suggestion:

Include a screenshot or infographic of the Earnin dashboard showing real-time balance and tip feature.

2. Brigit – Best for Budgeting Tools

- Advance Amount: Up to $250

- Fees: $9.99/month for premium

- Turnaround Time: Instantly with premium

- Requirements: 60 days bank history, regular deposits

Pros:

✔ Automatic budgeting alerts

✔ Identity theft protection included

✔ No interest

Cons:

✘ Monthly fee even if you don’t use cash advance

✘ Smaller advance limit

Case Study: Jason, a gig worker in Texas, uses Brigit to avoid overdraft fees. “The spending insights help me stay on track,” he says.

3. MoneyLion – Best for Credit Building

- Advance Amount: Up to $500

- Fees: Free or $1–$3 express fee

- Turnaround Time: 24 hours, instant with fee

- Requirements: Active bank account, income

Pros:

✔ Includes credit builder loans

✔ Financial tracking tools

✔ No interest on advances

Cons:

✘ Some features locked behind membership

✘ Lower limit for new users

4. Dave – Best for Small Emergencies

- Advance Amount: Up to $500

- Fees: $1/month + optional tips

- Turnaround Time: Same day (with express fee)

- Requirements: Steady income, bank account

Pros:

✔ Predicts upcoming bills

✔ Alerts to avoid overdrafts

✔ Affordable monthly fee

Cons:

✘ Requires Dave banking for full features

✘ Advance size may be too small for some needs

5. Chime SpotMe – Best for Overdraft Protection

- Advance Amount: Up to $200 (overdraft buffer)

- Fees: Free with Chime account

- Turnaround Time: Real-time overdraft cover

- Requirements: Chime account, $200 monthly deposits

Pros:

✔ No fees or tips

✔ Instant coverage at checkout

✔ Grows with use

Cons:

✘ Only works with Chime debit card

✘ Not a traditional cash advance

Visual Suggestion:

Infographic comparing Chime SpotMe vs Earnin vs Dave (features, fees, max advance)

6. Albert – Best for Smart Savings Features

- Advance Amount: Up to $250

- Fees: $8/month (Genius plan)

- Turnaround Time: Same day for premium

- Requirements: Bank account, recurring income

Pros:

✔ Automatic savings

✔ Personalized financial advice

✔ No interest

Cons:

✘ Monthly fee required

✘ No credit building

7. Possible Finance – Best for Building Credit History

- Advance Amount: Up to $500 (installment loan)

- Fees: APR varies by state

- Turnaround Time: 1–2 business days

- Requirements: Valid ID, bank account

Pros:

✔ Reports to credit bureaus

✔ Longer repayment time

✔ Available in 25+ states

Cons:

✘ Higher fees than other apps

✘ Not available nationwide

What to Watch Out For: Risks and Safety Tips

While cash advance apps are convenient, it’s vital to use them responsibly.

Risks:

- Over-reliance: Borrowing every pay cycle can create a cycle of debt.

- Fees Add Up: Even small tips or monthly fees add up over time.

- Data Privacy: Choose apps with strong data security and privacy policies.

Safety Tips:

- Limit usage to genuine emergencies

- Compare features and terms before choosing an app

- Check user reviews and app store ratings (aim for 4+ stars)

Visual Suggestion:

Pie chart showing “Why Americans Use Cash Advance Apps in 2025” – medical expenses, car repair, rent, etc.

FAQs – Answering Your Urgent Questions

Q1: Can I get a cash advance with no credit check in 2025?

Yes, most cash advance apps do not perform hard credit checks. Instead, they review your income and bank activity.

Q2: Are emergency cash advance apps legal in all U.S. states?

Most are legal, but some features vary by state laws. Always check availability in your location.

Q3: How fast can I get money from these apps?

Some apps offer instant transfers (within minutes) for a small fee; others take 1–2 business days.

Q4: Are these apps better than payday loans?

Generally, yes. They often have lower fees, no interest, and more flexible repayment.

Conclusion: Is a Cash Advance App Right for You?

In 2025, having access to fast cash through your phone can be a game-changer. But like any financial tool, the key is using it wisely.

Whether you’re like David, Emily, or Jason, the right app can provide short-term relief without long-term regret. Before downloading, consider your needs, budget, and repayment ability.

Have you tried any of these apps? What worked (or didn’t) for you? Share your experience in the comments or explore more money tips and tools on our site.

Explore U.S. consumer loan regulations for 2025 at Consumer Financial Protection Bureau